If you’re a business owner or accountant in Nigeria, you know the drill: the week of payroll is a sacred, stressful time. It’s a period dominated by complex Excel spreadsheets, manual PAYE calculations, frantic calls to banks for remittance advice, and the ever-present fear of FIRS penalties for miscalculations or late filings. This was the exact reality for, a Lagos-based furniture company with 53 employees. Their finance team, led by Accountant, was spending over 12 hours every month—the equivalent of one and a half working days—just to process payroll.

“It was a nightmare,” Chinedu recalls. “One formula error in a spreadsheet could throw off our entire tax calculation. We were constantly anxious about compliance. We knew we had to change, but most software wasn’t built for Nigeria’s specific statutory requirements.”

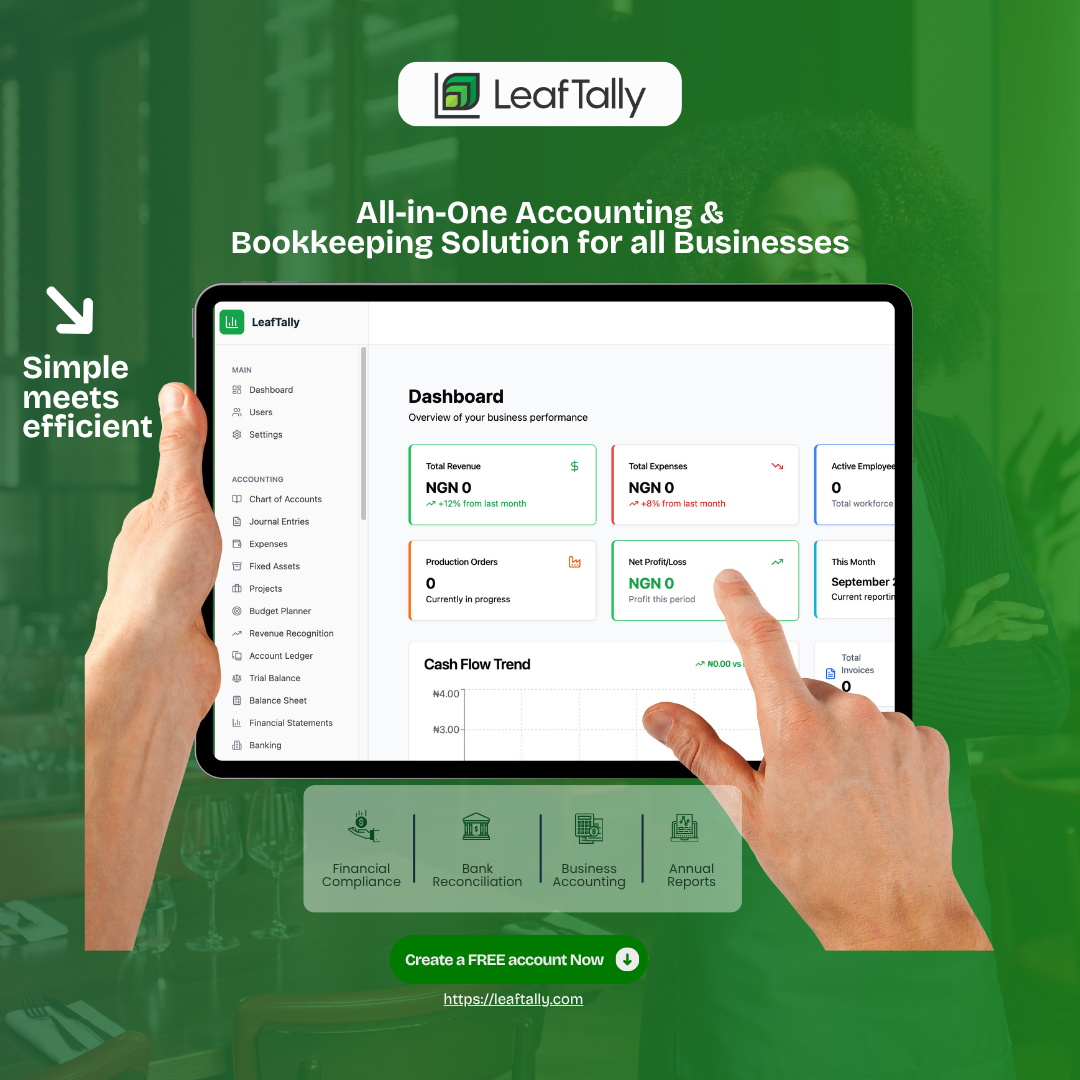

This case study details this Manufacturing company’s journey from manual chaos to automated clarity with Leaftally, reducing their payroll processing time from 12 hours to just 45 minutes using the automated payroll feature on Leaftally —an 89% increase in efficiency.

The High Cost of Manual Payroll in Nigeria

Before automation, Greenwood’s process was fraught with risks and inefficiencies:

-

Manual Data Entry: Manually inputting hours, overtime, and absences for 53 people.

-

Complex Statutory Calculations: Independently calculating PAYE, Pension (RSA), NHF, and NSITF for each employee, referencing ever-changing tax tables.

-

Bank Reconciliation Hell: Matching bank statements with payments to identify discrepancies.

-

Payslip Generation: Individually creating and emailing 53 payslips.

-

FIRS Filing: Manually compiling reports for monthly VAT and WHT remittances.

The hidden cost wasn’t just time; it was opportunity cost. Chinedu’s team could have been analyzing cash flow, advising management on cost-saving strategies, or improving budget forecasts.

The Leaftally Payroll Automation Blueprint: A Step-by-Step Breakdown

Here’s how Leaftally transformed their workflow:

Step 1: Centralized Employee Database

Leaftally replaced their scattered Excel files. They created a secure, cloud-based employee database where all details—bank accounts, tax IDs, pension details—are stored and automatically updated.

Step 2: Automated Statutory Calculations

This was the game-changer. Leaftally’s system is pre-loaded with Nigeria’s latest tax tables and compliance rules.

-

PAYE: The software automatically calculates the correct tax for each employee based on their earnings.

-

Pension: It deducts the correct 8% from the employee and calculates the company’s 10% contribution.

-

NHF & NSITF: It accurately computes these deductions, ensuring full legal compliance.

“Leaftally removed the mental burden of calculation,” says Chinedu. “We went from double-checking every figure to trusting the system’s accuracy implicitly.”

Step 3: One-Click Payslip Generation & Distribution

At the click of a button, Leaftally generates all 53 professional, branded payslips and distributes them directly to each employee via email or their secure portal. No more printing or manual emailing.

Step 4: Seamless Bank Integration & Payment Order

The platform integrates with their corporate bank account, allowing them to generate a single payment order for salaries and statutory remittances, drastically simplifying the reconciliation process.

Step 5: Direct FIRS & Pension Reporting

Leaftally automatically generates the compliant reports needed for monthly filings with the FIRS (VAT, WHT) and the Pension Commission. The data is always accurate and audit-ready.

The Result: More Than Just Time Savings

The impact on Greenwood Manufacturing was profound:

-

Time Saved: 12 hours → 45 minutes monthly.

-

Error Reduction: Eliminated calculation errors and near-miss filing penalties.

-

Employee Satisfaction: Faster, error-free payments and easy access to digital payslips.

-

Strategic Shift: The finance team transitioned from data processors to strategic advisors.

Ready to Reclaim Your Time?

You don’t have to be trapped in the payroll paradox. Leaftally is built by Nigerians, for Nigerian businesses, to solve these exact challenges.

Start Your Free Trial and Automate Your First Payroll in Under 30 Minutes

Stop spending your valuable time on manual tasks. Automate your payroll, ensure perfect compliance, and focus on growing your business.